This is the second of two consecutive Utility Information Pipeline issues reporting the results of the 2022 Utility Staffing Survey. 88 utilities, representing 25 states, ranging in size from 35 to 192,000 active accounts participated in the survey. This is the fourth biennial Utility Staffing Survey. For sake of comparison, here are the results from the 2020 Utility Staffing Survey.

The last issue summarized the demographics of the survey respondents as well as staffing levels and factors outside the control of the utilities. It also introduced the concept of using a value called Annual Accounts Billed per Office Employee to compare the staffing efficiency of different utilities. If you would like to calculate your utility’s Annual Accounts Billed per Office Employee value, I’ve created an online calculator to determine this value.

In addition to asking a series of demographic questions – the number of office employees, how many active customers, what services each utility bills, and annual customer turnover – the survey also asked how each utility handles various labor-intensive processes. Today’s issue deals with practices each utility can control, such as meter reading, payment processing, and bill printing.

If you participated in the survey and would like a copy of the graphs with your utility identified, please e-mail me.

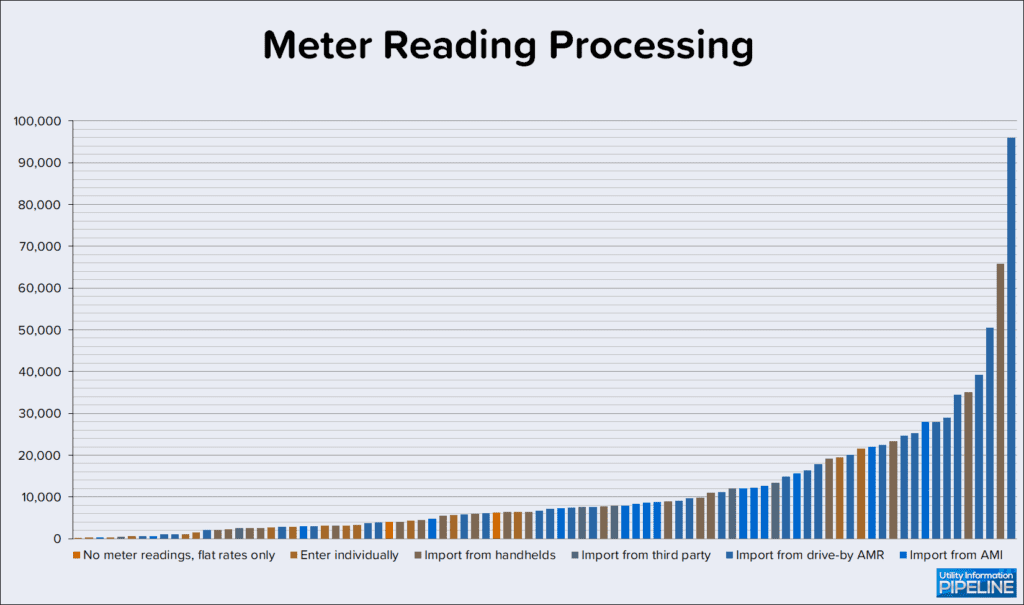

Meter reading processing

In terms of office staffing, the actual time savings with meter readings is only between manually entering readings or importing them from some sort of automated reading process. This year’s survey, in addition to breaking down how readings are imported, also included a category for utilities that only bill flat rates and don’t use meter readings at all.

As anticipated, most utilities responding to the survey have automated their meter reading process. Surprisingly, this year’s survey included 15 utilities that still enter meter readings, up from 13 two years ago. Two of these utilities were in the upper half of most efficiently staffed offices. The others were all within the bottom half of most efficiently staffed offices, as represented by the graph below (clicking on any of the graphs will open a larger image in a new window).

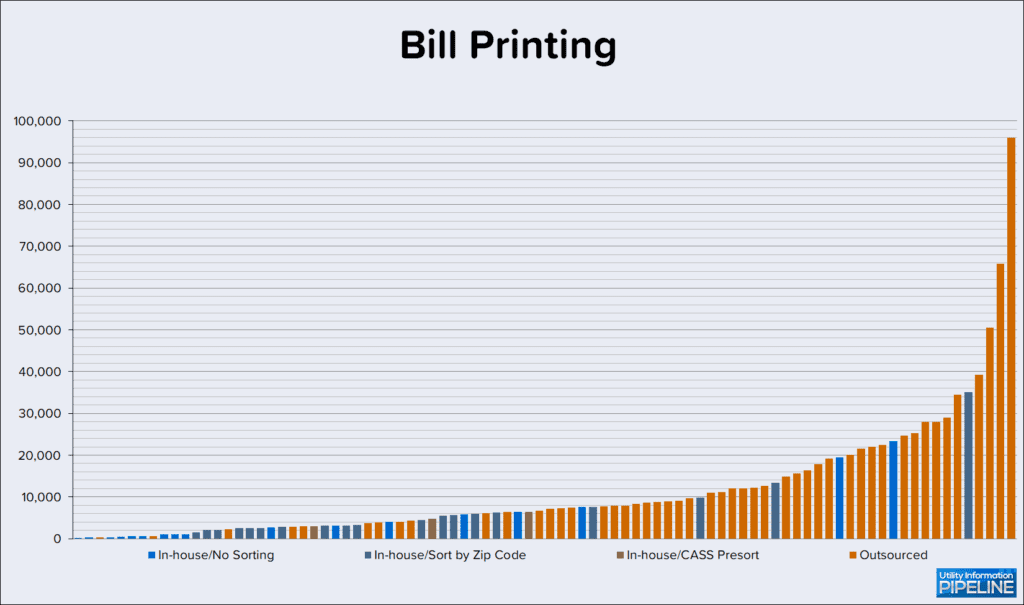

Bill printing

Bill printing and the related tasks required for preparing bills for mailing – separating postcards or folding and inserting full page bills, sorting, and traying the mail – are labor-intensive tasks.

Not surprisingly, the top 4 and 34 of the top 39 most efficiently staffed offices use an outsource printer to print their bills. On the other hand, only three of the 20 least efficiently staffed offices outsource the printing of their bills.

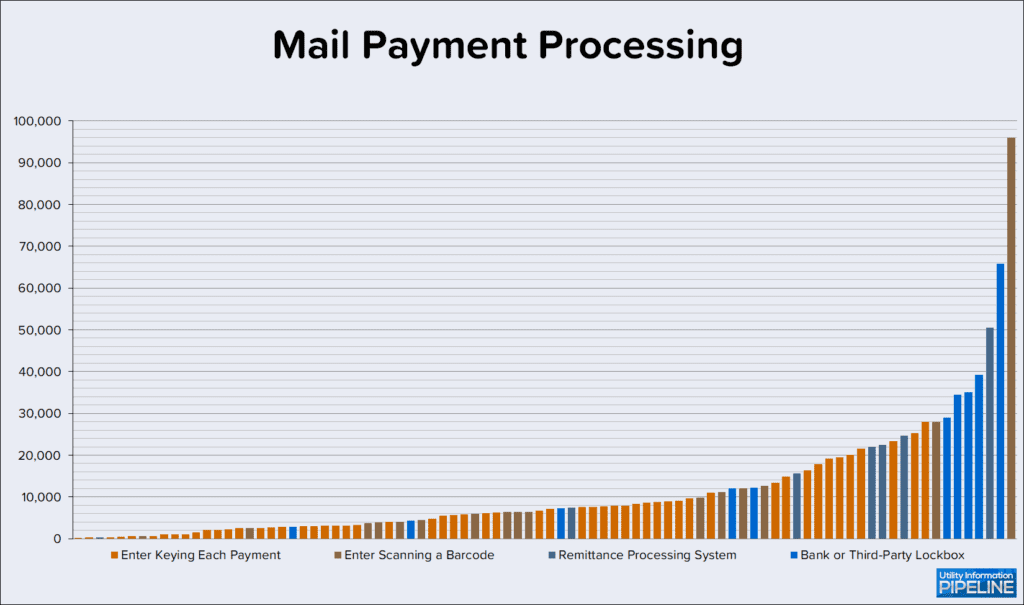

Mail payment processing

Mail payment processing is quite possibly the most laborious process in most utility offices. For that reason, many utilities have sought to automate the processing of mail payments, either by scanning barcodes on the bill, using a remittance processing system or a bank lockbox.

Surprisingly, this year’s survey had the largest number of utilities entering payments by keying them (62.5%) of all four years of the Utility Staffing Survey. The most efficiently staffed office processes mail payments by scanning a bar code. The next six most efficiently staffed offices either use a bank lockbox or a remittance processing system.

11 of the 14 most efficiently staffed utilities automate the mail payment process in some way, while 23 of the 27 least efficiently staffed utilities manually enter mail payments.

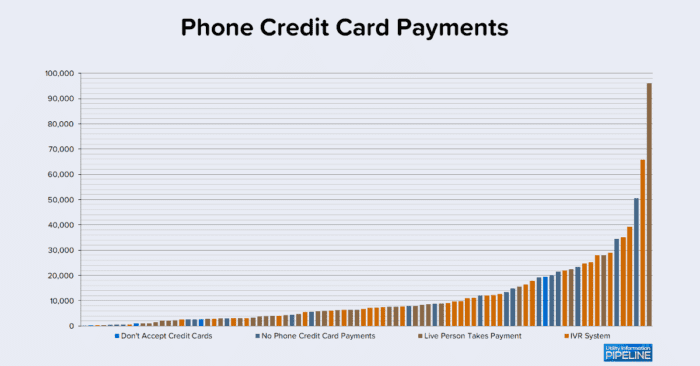

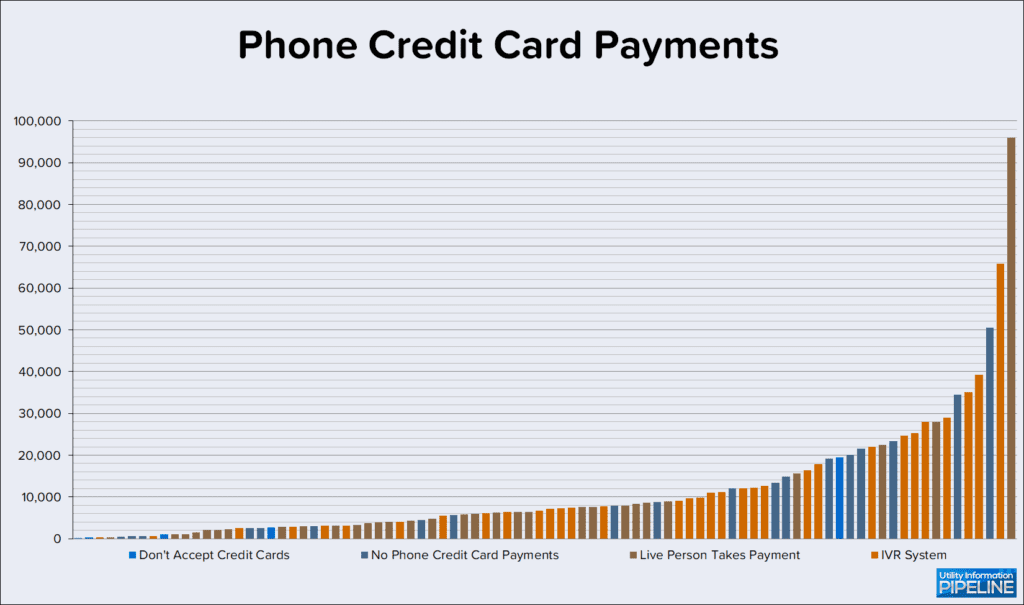

Phone credit card payments

The next area the survey asked about is phone credit card payments. This can be an extremely laborious process considering the customer service representative must look up the account, tell the customer how much is owed, take the credit card number, process the payment authorization and, finally, enter the payment in the system.

Five of the responding utilities don’t accept credit cards and 19 more don’t accept phone credit card payments. Of the rest, the results were almost evenly split between a live person taking the payment (31 responses representing 35.23%) and using an IVR system (33 responses or 37.50%.

One item that stood out to me is that use of an IVR system is the only factor among all of the office processes where there was a consistent, year-over-year increase since the inception of the Utility Staffing Survey. Use of IVR systems has increase each year from 24.66% in 2016 to 37.50% this year.

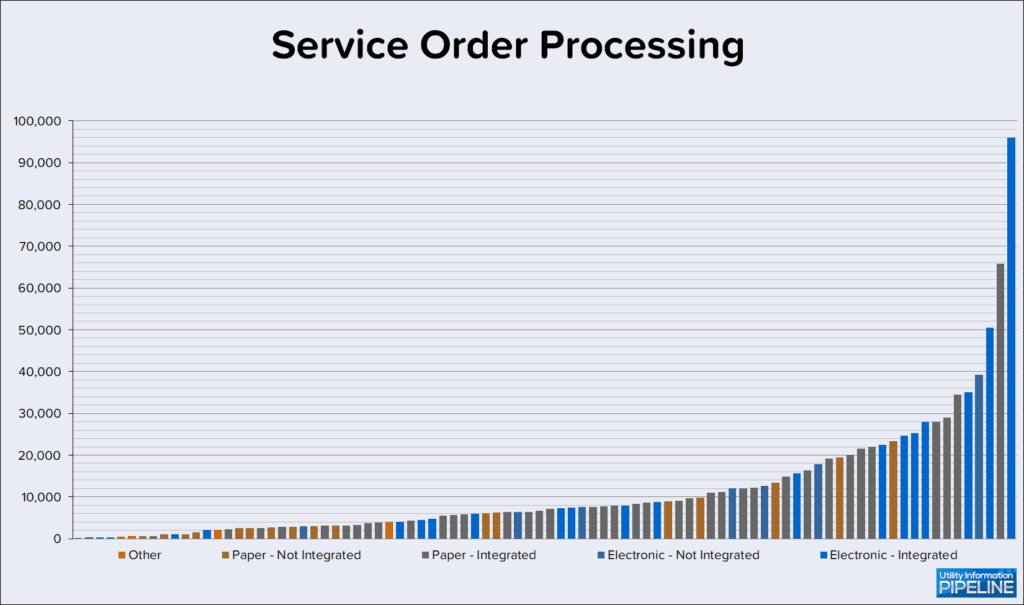

Service order processing

The final area of the survey is service order processing. The survey queried whether utilities used paper or electronic service orders and if they were integrated with the billing software or not.

14 of the 16 most efficiently staffed offices use service orders that are integrated with their billing software, whether paper or electronic. 20 of the 88 utilities, or 22.73%, use electronic service orders integrated with their billing software, up two percentage points from 2020.

Four utilities chose the “Other” response and here are their responses:

- Paper on our end with software, electronic on contractor end

- Take customer’s call and handle the situation

- We don’t process services orders

- We have no service orders

Is your office adequately staffed?

If you think your utility is understaffed or could operate more efficiently, please give me a call at 919-673-4050 or email me at gary@utilityinformationpipeline.com to learn how a business review could help you determine this.

Increasing revenues webinar

I will be leading the third in a series of four webinars for MuniBilling on Thursday, December 15 at 11:00 am, entitled How to Increase Revenue without Raising Rates. The webinar will highlight options for fees – some commonly used and others often overlooked – to consider when updating your schedule of fees. If you are interested in attending, you can register for the webinar by clicking here.

© 2022 Gary Sanders