Every other year, in even-numbered years, I conduct the Utility Staffing Survey. This survey examines staffing levels and how utilities handles labor-intensive practices such as meter reading, bill printing, payment processing, and service orders. It also looks for trends as to how more efficiently staffed offices operate. Here are links to other Utility Staffing Surveys:

2022 Utility Staffing Survey Results

2020 Utility Staffing Survey Results

2018 Utility Staffing Survey Results

The Utility Staffing Survey alternates years with the Utility Fee Survey, which is conducted in odd-numbered years. Below are the results of the 2016 Utility Staffing Survey, which was the first Utility Staffing Survey.

Demographics of survey respondents

73 utilities, representing 20 states, ranging in size from 200 to 80,000 active accounts participated in the survey. Click on the links below to see charts of the various demographic data:

Size of utilities under 20,000 accounts responding

Services provided by responding utilities

Accounts per employee

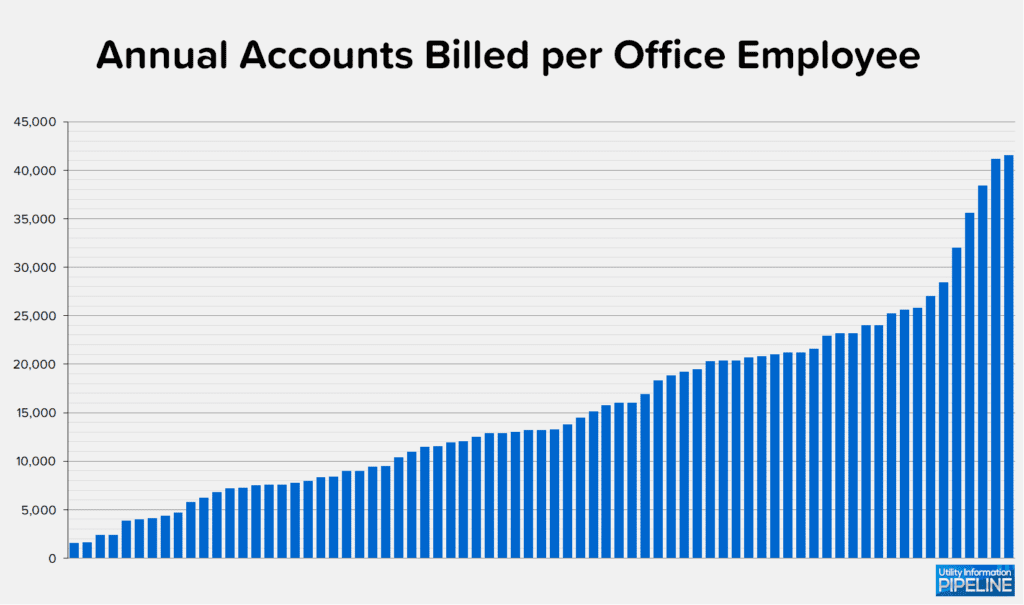

To arrive at an accurate index to compare utilities of differing sizes and billing frequencies, I came up with the number of accounts billed annually per employee. This formula multiplied the number of active accounts by the number of times each account is billed annually (12 for monthly billing, 6 for bi-monthly billing and 4 for quarterly billing) then divided that product by the total number of office employees. The higher the result, the more efficient the office should be.

The results ranged from 1,583 to 41,570 as represented by the graph below (clicking on any of the graphs will open a larger image in a new window).

One disclaimer applies. At least two of the top six most efficient offices are local governments where payments are taken in a different department, so their staffing numbers do not include cashiers.

Annual customer turnover

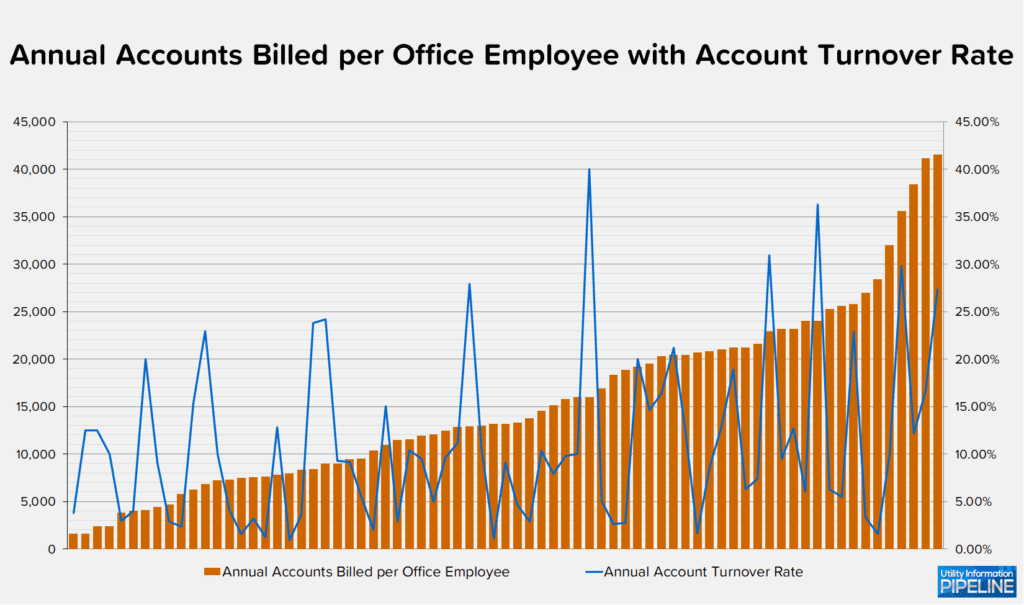

I wondered if the turnover in customers would be a factor in how efficiently offices are staffed, so the survey asked how many applications for service (including routine move in/move outs and new construction) each utility processes per year.

One question the survey didn’t ask, which in retrospect it should have, is if the utility bills tenants or only property owners. Obviously, those utilities billing only property owners have a much lower turnover rate than utilities billing tenants.

Not surprisingly, the annual turnover rates ranged widely, from .94% to 40.00%. On the low end is a utility in a predominately rural area that only bills property owners. On the high end is a City with multiple college campuses that bills tenants.

As you can see from the graph below, there is no correlation between annual turnover rates and office efficiency.

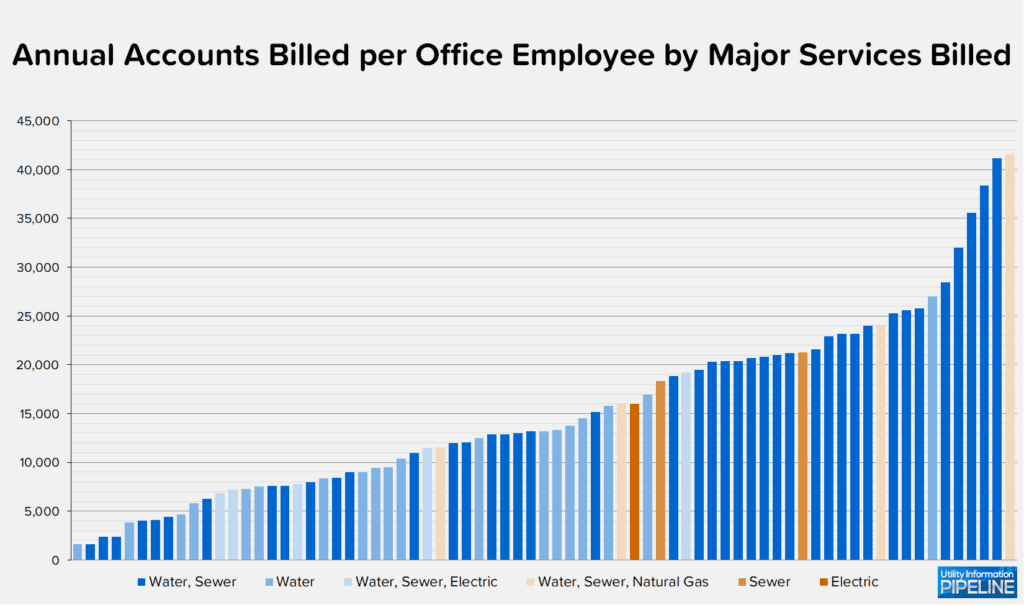

Services billed

The final variable I examined for this issue was major services billed (water, sewer, electric and natural gas) looking for a correlation between the number of services billed and office staffing. I only considered the major services, because other services, such as garbage, stormwater, or area lights, generally are billed as flat-rate services and are not nearly as labor intensive to bill. Even though sewer is not generally a metered service, I considered it to be a major service because some of the responding utilities bill only for sewer.

I anticipated utilities billing multiple metered services would require more staff than those billing for only a single metered service. This proved to be the case, as 23 of the 25 most efficient offices bill for only one metered service, as shown below. The one anomaly was the most efficient office, which happens to be one of the utilities mentioned above that doesn’t collect payments.

Meter Reading Processing

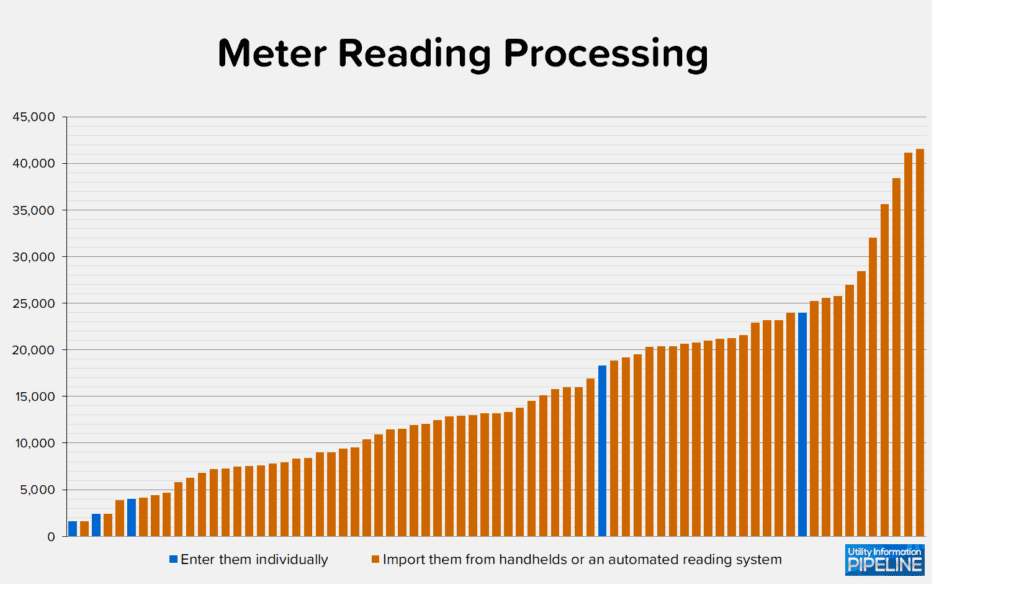

Because this survey was focused on office staffing, the meter reading question only distinguished between manually entering readings or importing them from some sort of automated reading process. The survey did not distinguish between whether the imported readings were from handhelds or an AMR or AMI system.

As expected, most utilities in the survey have automated their meter reading process, as only five of the responding utilities still enter meter readings. Somewhat surprisingly, two of these utilities were in the upper 50% of most efficiently staffed offices. The other three were all within the six least efficiently staffed offices, as represented by the graph below.

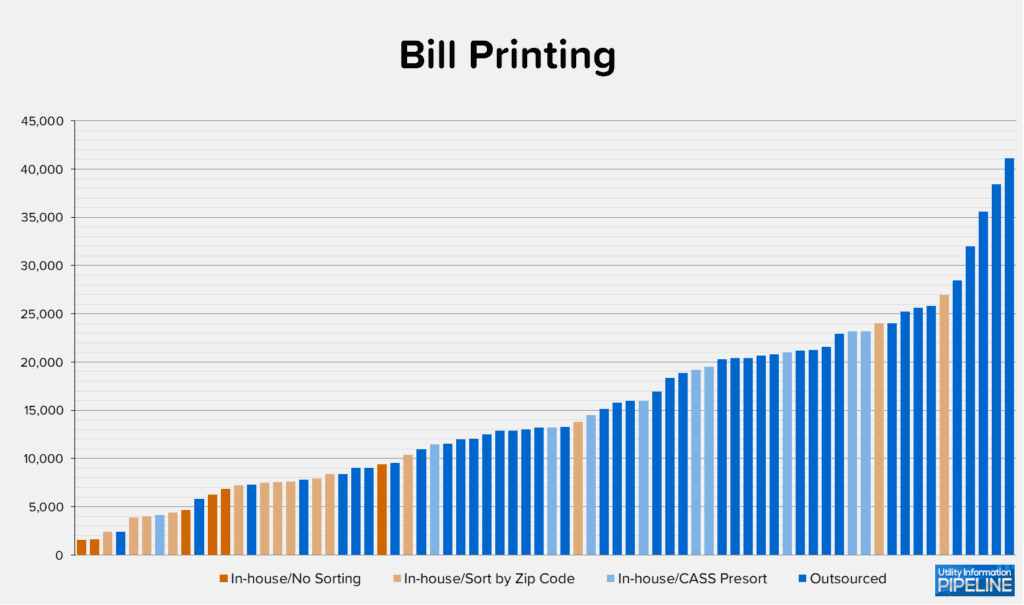

Bill Printing

Bill printing and the related tasks required for preparing bills for mailing – separating postcards or folding and inserting full page bills, sorting, and traying the mail – are very labor intensive tasks.

Not surprisingly, the top six and 19 of the top 24 most efficiently staffed offices use an outsource printer to print their bills. On the other hand, only four of the 20 least efficiently staffed offices outsource their billing printing.

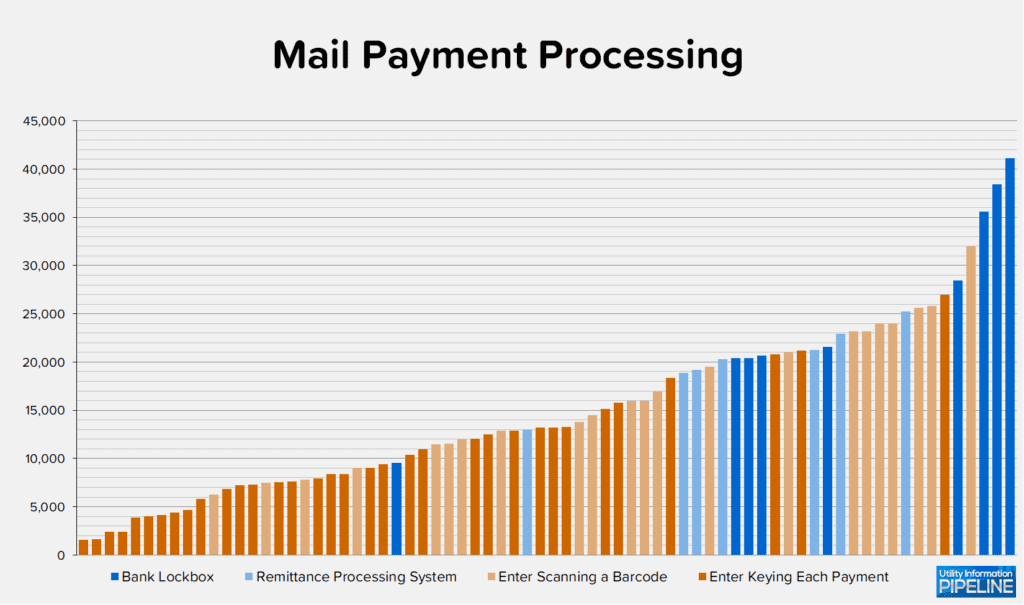

Mail Payment Processing

Mail payment processing is quite possibly the most labor intensive process in most utility offices. For that reason, many utilities have sought to automate the processing of mail payments, either by scanning barcodes on the bill, or using a remittance processing system or a bank lockbox.

As anticipated, 27 of the 31 most efficient utilities automate the mail payment process in some way, while the bottom 10 and 20 of the 24 least efficient utilities manually enter mail payments.

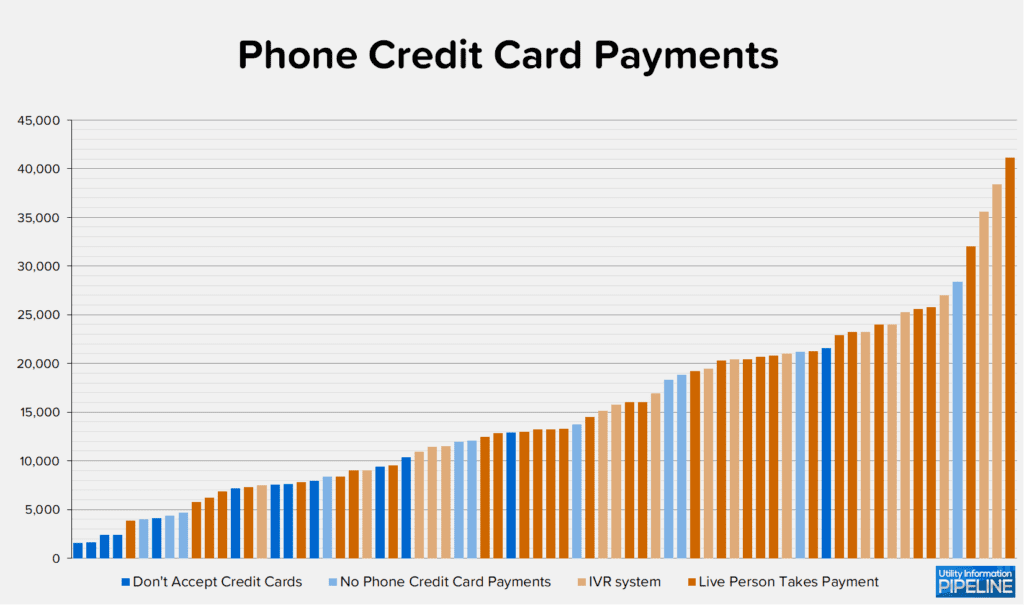

Phone Credit Card Payments

The final area the survey asked about is phone credit card payments. This can be an extremely laborious process considering the customer service representative must look up the account, tell the customer how much is owed, take the credit card number and process the payment authorization and, finally, enter the payment in the system.

Somewhat surprisingly, 13 of the 26 most efficiently staffed offices have a person in the office take phone credit card payments.

Is your office adequately staffed?

If you think your utility is understaffed or could operate more efficiently, please give me a call at 919-673-4050 or e-mail me at gary@utilityinformationpipeline.com to learn how a business review could help you determine this.