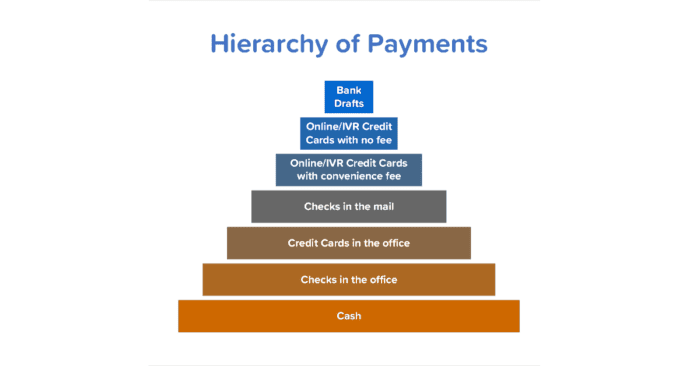

I recently saw a social media post ranking NFL quarterbacks into tiers. This got me thinking about random hierarchies like the food pyramid and Maslow’s Hierarchy of Needs, which led to the idea of a hierarchy of payments. I’ve always maintained that bank drafts are the best way to collect payments, but what about the second, third, or even last place options?

Here is my Hierarchy of Payments, along with the rationale for my selections.

Bank Drafts

Quite simply, bank drafts are the easiest way to collect payments. Your customer provides their bank account information and your billing software creates an ACH file (if it doesn’t, you need new software – this is 2022, after all!). You then upload the ACH file to your bank and, on the designated draft day, the money is deposited in your account. Finally, you convert the draft data to payment transactions in your software (if you can’t, see above!) and you are finished! Bank draft fees, if your bank charges one, are in most cases less than credit card fees.

Online/IVR Credit Cards with no fee

In second place are online or IVR (automated phone) payments with no convenience fee. Online and IVR payments should be as seamless as bank drafts. If they aren’t, you need to find a different online payment provider or software vendor. You may be wondering why online and IVR payments with no fee ranked are ahead of those with a convenience fee. Quite simply, more customers will pay by credit card if they don’t have to pay an additional fee.

Online/IVR Credit Cards with convenience fee

Online and IVR payments with a convenience fee still rank ahead of the other payment options for their ease of processing, even if some customers will be deterred from paying this way because of the convenience fee.

Checks in the mail

Next are checks in the mail, which rank ahead of any of the in-office forms of payment. If you use a lockbox, this is generally a very efficient way to process payments. If not, you must open the mail, enter the payments, and prepare a bank deposit. If you have a check scanner and your bank accepts remote deposit capture check deposits, depositing checks is much simpler than taking them to the bank to deposit.

Credit Cards in the office

All three in-office payment methods rank in the bottom three because they all involve dealing with the public, which can be time consuming. Taking time to deal with the public directly impacts productivity. Credit cards are favored over checks and cash because no bank deposit is required.

Checks in the office

Checks in the office generally involve interacting with the public, although some customers do just drop off their bill stub and check without waiting for a receipt. However, the payment must still be entered in the system and a check deposit prepared.

Cash

Finishing in last place are cash payments. Cash payments, in addition to the same bad rap as the other in-office payments, require your cashiers to make change and the cash drawer must be counted at the end of the day. And a bank deposit at a physical bank is required for cash deposits.

Do you have other ideas?

Do you disagree with my hierarchy? Would you rank them differently? Let me know what you think by posting a comment here.

Looking for more efficient payment options?

Does your office need help with finding more efficient ways to process payments? If so, please give call me at 919-673-4050 or email me at gary@utilityinformationpipeline.com to learn how a business review could help.

2022 Utility Staffing Survey

There’s still time to complete the 2022 Utility Staffing Survey, if you haven’t already participated.

If you’d like to complete the 2022 Utility Staffing Survey, please click here. This should only take a few minutes to complete and I will publish the results in future newsletters.

Thank you in advance for taking the time to complete the survey and please feel free to share it with your peers at other utilities.

© 2022 Gary Sanders

Where would Kiosks fall?

Gregory,

That’s a great question! So few utilities use kiosks that I didn’t even consider them. Assuming the kiosk was integrated with the billing software and didn’t require any manual re-keying of payments and there was no fee to the customer, I think I would rank it right below Online/IVR Credit Cards with no fee. The only reason I would put it below online payments is the kiosk most likely requires a larger up-front investment and ongoing maintenance than a website does.

Thanks!

Gary