Each year for the past several years, fiserv has published a report of consumer payment trends. I find these to be interesting and informative and I’ve used them as the source for previous newsletters. Interestingly, the title of the most recent report hints at this becoming a quarterly report.

You can read the April report here and the last several years’ reports here.

Credit and debit cards are most popular

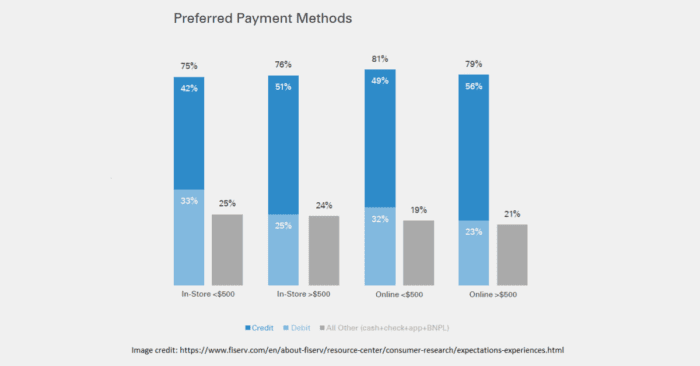

Not surprisingly, credit and debit cards were found to be more popular than cash, checks, or mobile payments, as shown by this graphic from the report (clicking on any of the graphics will open a larger image in a new window):

Since this data is based on all consumer payments – such as restaurants, concert or sporting event tickets, and grocery stores – I suspect the results may be different for utility bill payments. My instincts tell me that for regular, monthly bills like mortgage or rent, car payments, and utilities may people still prefer to pay by check or schedule a payment from their bank’s online banking.

In-person payments

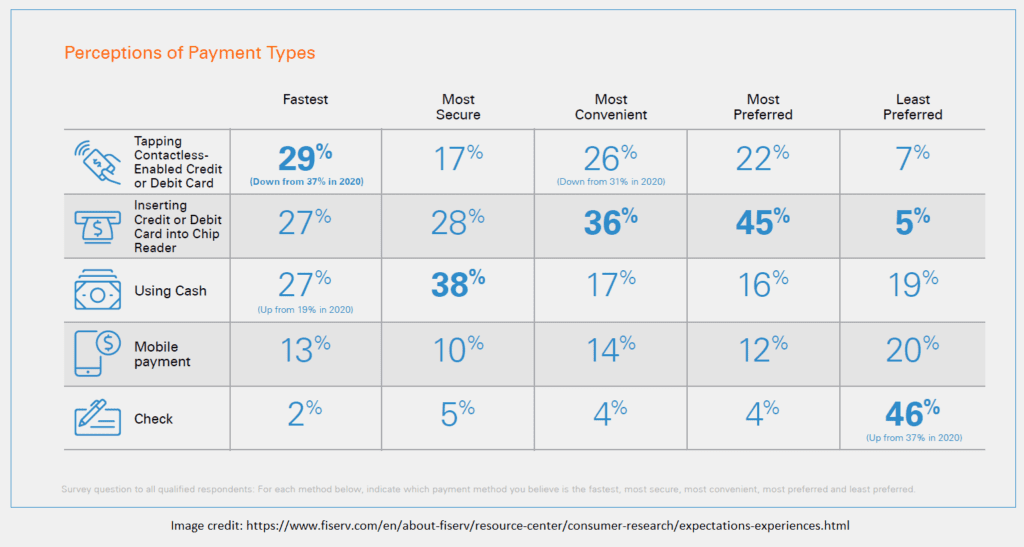

As shown by the graphic below, for in-person payments, tapping a contactless-enabled card is considered the fastest:

Cash is considered the most secure, which I find interesting. I can see where customers would think that paying by cash is more secure than using a credit card due to no opportunity for potential credit card fraud. However, personally, I find carrying large amounts of cash to be less secure than risking using a card.

Inserting a chip card is considered the most convenient, most preferred, in last place for least preferred. Checks are far and away to least preferred option for paying in person. Again, I suspect this might be different for paying a utility bill where the amount of the payment is known in advance (and the check can be already filled out before arriving at your office) than in a retail setting where the check has to be completed on the spot.

What are the takeaways?

It is 2022, after all, and there are so many options for accepting card payments these days, there is no excuse for not doing so. If you aren’t currently accepting debit or credit cards, clearly this report indicates it’s time to start! You can even avoid any fees for your utility by charging your customers a third-party convenience fee.

Secondly, if you are still swiping credit cards for in-office payments, it’s time to upgrade your equipment. Your customers expect to be able to insert or tap their cards to make in-person payments.

Are your payment methods out-of-date?

If you still aren’t accepting credit cards or if your credit card devices are out-of-date, please give call me at 919-673-4050 or email me at gary@utilityinformationpipeline.com to learn how a business review could help rectify that.

2022 Utility Staffing Survey

Response to the 2022 Utility Staffing Survey is still lagging behind where it was for the 2020 Utility Staffing Survey, so if you haven’t yet completed the survey, please consider doing so.

Please click here to complete the 2022 Utility Staffing Survey. This should only take a few minutes to complete and I will publish the results in future newsletters.

Thank you in advance for taking the time to complete the survey and please feel free to share it with your peers at other utilities.

© 2022 Gary Sanders