A recent post on one of the listservs I subscribe to asked about how other utilities deal with customers who pay online using an echeck to defer disconnection on cut-off day. In this case, a customer would enter the echeck information, knowing there weren’t currently enough funds in their account to cover the payment, hoping to extend their disconnection by a few days.

The listserv post asked if other utilities go back and add the cut-off fee if the customer used a bounced echeck to avoid being disconnected on cut-off day.

What are echecks?

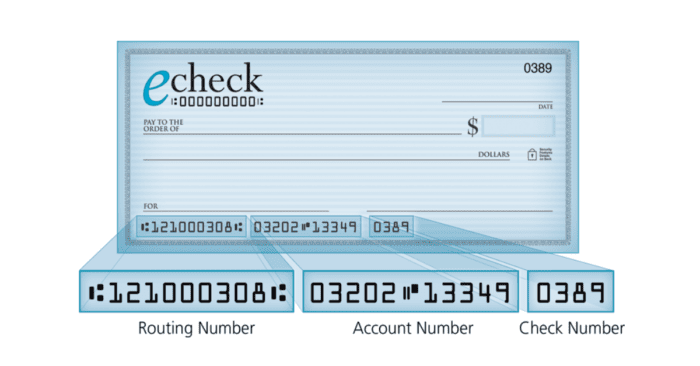

Echecks, short for electronic checks, are customer-initiated, online transactions where the payment is deducted from the customer’s bank account, rather than charged to a credit card. The customer enters the routing number and account number for their bank account and the payment is processed as an ACH transaction, just like a bank draft. Let’s look at some echeck pros and cons.

Echeck pros

Echecks enable your customers who don’t have a credit or debit card to pay online, eliminating one more cash or check payment.

Another advantage of echecks is the fees are generally less than credit card processing fees. Therefore, if you absorb the cost of online payments, echecks cost less to process than credit cards. If you do charge a convenience fee, typically your customer would pay less of a fee than for a similar credit card payment.

Echeck cons

Unlike credit cards, which are validated and funds held at the time of entry, echecks are not. Because they are processed as ACH transactions, validation of the routing and account numbers and confirmation of available funds happens when the transaction is processed by the customer’s bank.

This means an honest mistake, such as mis-typing a number, can lead to a returned echeck payment. It also means a savvy dishonest customer might abuse the process to avoid being cut-off.

What is the solution?

First of all, be sure you charge the same returned check fee for a returned bank draft or echeck payment as you would a bounced check.

If your online payment platform allows the option, consider disabling echeck payments just prior to cut-off day. If you don’t accept checks for customers who have been disconnected, why would you allow them to pay using an echeck?

Finally, if the returned echeck payment kept the customer from being disconnected on cut-off day, immediately cut them off as soon as the echeck is returned. Be sure to add the cut-off fee they tried to avoid to their account, as well.

Complete the 2023 Utility Fee Survey

If you haven’t already completed the 2023 Utility Fee Survey, and would like to, please click here to complete the survey. It should take less than five minutes to complete.

If you have any questions, please feel free to e-mail me at gary@utilityinformationpipeline.com or call me at 919-673-4050.

Thank you in advance for your participation in the 2023 Utility Fee Survey.

Should your office offer additional payment methods?

If you’ve ever wondered if your office is taking advantage of all possible payment options, please give me a call at 919-673-4050 or email me at gary@utilityinformationpipeline.com to learn how a business review could help you find out.